Designed to ease the concerns of life’s golden years, our Senior Citizen’s ‘BAHUMANA’ Insurance offers a comprehensive plan specifically tailored for your retirement chapter. Acting as your safeguard against unforeseen circumstances, this inclusive plan guarantees financial security in the event of accidental death, permanent total or partial disability, and covers funeral and hospitalization expenses. Make the smart choice for your well-being with our Senior Citizen’s ‘BAHUMANA’ Insurance-because your peace of mind matters.

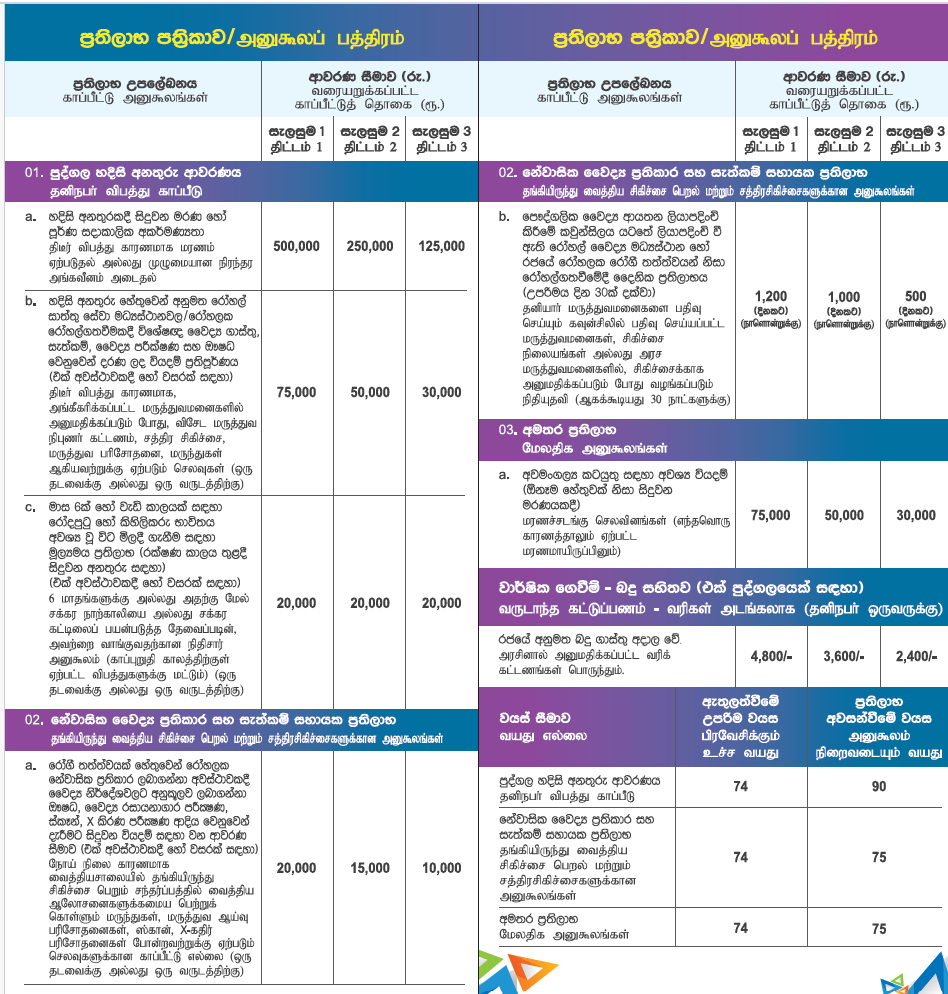

| Benefit | Minimum Age at Entry | Maximum Age of Entry | Benefit Termination Age |

|---|---|---|---|

| Personal Accident Benefits 1A. Accidental Death or Permanent Total/Partial Disablement 1B. Hospitalization due to Accidental Injury 1C. Mobility Assistance Cover |

55 | 74 | 90 |

| Medical and Surgical Supportive Benefits 2A. Drugs and Diagnostic Investigation Benefit 2B. Hospital Cash Benefits |

55 | 74 | 75 |

| Funeral Expenses Benefits | 55 | 74 | 75 |

This section covers personal accident benefits. If, within 90 days of an accident, it is proven to us that the Policyholder’s death or Permanent Total/Partial Disablement was solely and directly caused by that accident, we will provide compensation as stated in the Policy’s terms and conditions. Please note that for the same accident, you cannot claim more than one benefit available under this section.

If you are admitted to a hospital due to an accidental injury, we pay the eligible expenses as stated in the Policy Schedule. This includes charges such as admission fees, room and intensive care charges, administrative costs, and various medical expenses. We also cover surgeon’s, anesthetist’s, and consultant’s fees, as well as specialist services like X-rays and physiotherapy. All of this is subject to the terms and conditions mentioned in your policy.

We provide financial assistance to buy a wheelchair, crutches, or an artificial limb if a consultant physician recommends it for a period of six months or more due to an accident that happened during the Policy period. You are not entitled to claim more than once for the same accident.

If any or more of the following events take place, we are not liable to pay expenses that arises directly or indirectly.

We cover the expenses for drugs and diagnostic tests, including scans and X-rays, incurred during your stay in an approved hospital due to illness or sickness.

We provide a daily allowance if you are hospitalized in a registered private or government medical institution for up to 30 days due to illness or sickness.

In the unfortunate event of death, we offer a lump sum payment irrespective of the cause. Please be aware that certain age limits defined in the Policy are applicable.

If any or more of the following events take place, we are not liable to pay expenses that arises directly or indirectly.

Hospitalizations shorter than 48 hours.

Any expenses incurred or hospitalization during the first 30 days from the start of your coverage.

Skin diseases, cosmetic surgeries, and treatments/procedures such as removing abscesses, cysts, warts, breast lump removal, plastic/cosmetic surgeries, and physiotherapy.

Any expenses incurred or hospitalization related to pregnancy, childbirth, miscarriage, abortions, and any related conditions (e.g. hypertension due to pregnancy), contraceptives, infertility treatments, sexual dysfunction treatments, and procedures related to impotence or sterilization.